mdv-yk242.ru

Market

Investor Roi

Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. Calculating ROI and ROE · ROI = (net return/cost of investment) X · ROE = (net income/shareholders' equity) X ROI is calculated by dividing the net income from an investment by the original cost of the investment, the result of which is expressed as a percentage. ROI, or return on investment, is the projected or calculated value earned after spending money or time to create and market a product. Return on investment (ROI) measures the profit or loss generated on an investment relative to the amount of money invested. Return on investment (ROI), or simply ROI, is a profitability ratio that measures the gain or loss generated from an investment, according to the amount of. ROI is a calculation of the monetary value of an investment versus its cost. The ROI formula is: (profit minus cost) / cost. If you made $10, from a. To calculate ROI is to take the gains of an investment, subtract the cost of the investment and divide the result by the cost of the investment. Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. Calculating ROI and ROE · ROI = (net return/cost of investment) X · ROE = (net income/shareholders' equity) X ROI is calculated by dividing the net income from an investment by the original cost of the investment, the result of which is expressed as a percentage. ROI, or return on investment, is the projected or calculated value earned after spending money or time to create and market a product. Return on investment (ROI) measures the profit or loss generated on an investment relative to the amount of money invested. Return on investment (ROI), or simply ROI, is a profitability ratio that measures the gain or loss generated from an investment, according to the amount of. ROI is a calculation of the monetary value of an investment versus its cost. The ROI formula is: (profit minus cost) / cost. If you made $10, from a. To calculate ROI is to take the gains of an investment, subtract the cost of the investment and divide the result by the cost of the investment. Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost.

Return on investment is a measure used to evaluate the efficiency of an investment or to compare the efficiencies of number of investments. To calculate the ROI. Return on Investment is a key business metric that measures the profitability of investments or marketing activities by weighing the size of the upfront. Calculating return on investment that a project gives your business is essential for reviewing performance. Use our return on investment calculator here. The Investor Relations website contains information about Retail Opportunity Investments Corp.'s business for stockholders, potential investors. Free return on investment (ROI) calculator that returns total ROI rate and annualized ROI using either actual dates of investment or simply investment. A “good” ROI is highly subjective because it largely depends on how risk-tolerant a particular investor is. But as a rule of thumb, most real estate investors. To find the best investment, investors must analyze ROI calculations for different scenarios to see which produces the higher number, or higher return. This is. “If we want to calculate the performance of a company, we can use the return on total assets ratio, which is, in a sense, a specific application of ROI. ROI is. ROI (Return on Investment) refers to the level of returns made through an investment by measuring net income against its original cost over a period of time. Return on investment is a measure used to evaluate the efficiency of an investment or to compare the efficiencies of number of investments. To calculate the ROI. Return on Investment (ROI) is a profitability ratio that compares the net profits received at exit to the original cost of an investment. Return on investment (ROI) is a financial ratio, used as a metric to evaluate investments and rank them compared to other investment choices. Investment Calculator · How Investing Works · How to Calculate Return on Investment (ROI) · Factors to Consider Before You Invest. Shareholders can calculate the value of their stock investment in a particular company by use of this formula: ROI = (Net income + (Current Value - Original. Real estate investors rely on ROI to determine how much profit a property will return and how it compares to other properties. Learn how to calculate ROI. A high ROI means the investment's gains compare favourably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to. Here's the equation for finding the ROI percentage of an asset: ROI= [(Final value of investment - Initial value of investment) / Initial value of investment]. The ROI calculator is a simulation that helps you gauge the profitability of your investments. You may use the ROI calculator to determine the return from. How much profit you've made from your ads and free product listings compared to how much you've spent on them. To calculate ROI, take the revenue that. How Do You Calculate Return on Investment? To calculate ROI, you first add income received — interest or dividends — to the ending investment value. Then, you.

What Is The Average Rate For Mortgage

View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Today, the average year fixed mortgage rate went to %. The average year FRM hit a record weekly low of % on July 29, , and a record weekly. The New York mortgage interest rate on September 13, is down 9 basis points from last week's average New York rate of %. Additionally, the current. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. r/FluentInFinance - Mortgage rates have hit a Compare Today's Year Mortgage Rates. As of September 13, , the average year-fixed mortgage APR is %. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Today, the average year fixed mortgage rate went to %. The average year FRM hit a record weekly low of % on July 29, , and a record weekly. The New York mortgage interest rate on September 13, is down 9 basis points from last week's average New York rate of %. Additionally, the current. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. r/FluentInFinance - Mortgage rates have hit a Compare Today's Year Mortgage Rates. As of September 13, , the average year-fixed mortgage APR is %.

We have two that show you what mortgage interest rates mean for you as a home buyer. A mortgage rate lock keeps your interest rate from changing for a period. Loan amount * Estimated average over the life of the loan. Payments may vary. Y30FConfCombMtg|Y15FConfCombMtg|Y7ARMMtg|Y3ARMConfCombMtg|Y1ARMMtg. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. Today's Mortgage Rates. Find daily average rates for mortgage purchases and refinancing your home loan; Learn how different types of loans — from. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, The current average year fixed mortgage rate fell 2 basis points from % to % on Friday, Zillow announced. The year fixed mortgage rate on. What Are Freedom Mortgage's Current Interest Rates? · What Factors Can Affect Your Mortgage Rate? · What Is the Difference Between Fixed- and Adjustable-Rate. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. The national average mortgage rate is %. Find out what your personal How does the mortgage interest rate differ from the annual percentage rate (APR)?. The average rate on a year fixed mortgage held steady at % as of September 5th, remaining at its lowest level since mid-May , according to Freddie. As of Sept. 13, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. On Friday, Sept. 13, , the average interest rate on a year fixed-rate mortgage dropped nine basis points to % APR. The average rate on. 5/1-Year Adjustable Rate Mortgage Average in the United States (DISCONTINUED). Percent, Weekly, Not Seasonally Adjusted to (). The average rate at the time of publication is %. However, this figure is an average, and individual rates can vary widely based on personal circumstances. The current average year fixed mortgage rate fell 2 basis points from % to % on Saturday, Zillow announced. The year fixed mortgage rate on. In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet. The average contract interest rate for year fixed-rate mortgages with conforming loan balances ($, or less) edged 1bps lower to % in the week ended. See the average year mortgage rate for the last 10 years. year national mortgage rates have hovered between % and % since

What Are The Most Collectible Coins

Over 30 billion coins are estimated to be in circulation in the United Kingdom today. The Royal Mint has been creating coins since AD and, as such. 9 most valuable U.S. coins · Value $M · Composition 95% copper, 5% tin and zinc · Year issued · Notes Today, pennies are made from copper-coated zinc. The Double Eagle is currently the rarest and most valuable coin in the world, with an estimated value of around $20 million. Rare Coins to Look For · Silver Dollar Class I · Liberty Head Nickel · Brasher Doubloon · Flowing Hair Silver Dollar · Lincoln Head. The 9 rarest and most valuable US quarters represent not only the evolution of American coinage, but also the rich history of the nation. Most Valuable Coins in Circulation Worth Money · 1. D Sacagawea Dollar Muled with Presidential Dollar · 2. Flowing Hair Dollar Special Strike · 3. U.S. coins make fascinating collectibles, as they're a distinctive piece of history. Here are some of the most valuable U.S. coins in the US. The Ultimate List of Valuable Coins ; Morgan Silver Dollar · Morgan Silver Dollar · $k ; Steel Wheat Penny · Steel Wheat Penny · $k ; Morgan. List of most expensive coins ; $6,,, , Umayyad Gold Dinar ; $5,,, , Brasher Doubloon - EB on Wing ; $5,,, , $10 Proof Eagle - DCAM. Over 30 billion coins are estimated to be in circulation in the United Kingdom today. The Royal Mint has been creating coins since AD and, as such. 9 most valuable U.S. coins · Value $M · Composition 95% copper, 5% tin and zinc · Year issued · Notes Today, pennies are made from copper-coated zinc. The Double Eagle is currently the rarest and most valuable coin in the world, with an estimated value of around $20 million. Rare Coins to Look For · Silver Dollar Class I · Liberty Head Nickel · Brasher Doubloon · Flowing Hair Silver Dollar · Lincoln Head. The 9 rarest and most valuable US quarters represent not only the evolution of American coinage, but also the rich history of the nation. Most Valuable Coins in Circulation Worth Money · 1. D Sacagawea Dollar Muled with Presidential Dollar · 2. Flowing Hair Dollar Special Strike · 3. U.S. coins make fascinating collectibles, as they're a distinctive piece of history. Here are some of the most valuable U.S. coins in the US. The Ultimate List of Valuable Coins ; Morgan Silver Dollar · Morgan Silver Dollar · $k ; Steel Wheat Penny · Steel Wheat Penny · $k ; Morgan. List of most expensive coins ; $6,,, , Umayyad Gold Dinar ; $5,,, , Brasher Doubloon - EB on Wing ; $5,,, , $10 Proof Eagle - DCAM.

The Liberty Head Nickel is one of the most famous and valuable coins in the world. It is a rare five-cent piece which was produced in extremely limited. The Rarest Coins in the World · Silver Dollar, Class I · Flowing Hair Silver Dollar · Saint Gaudens – Double Eagle · Edward III Florin · American Silver Eagles. The American Silver Eagle coins began production in the s and are easily recognizable by many coin collectors. Newer Eagle coins can. This guide will list the most popular silver coins, the value each holds currently, and how to tell the difference between fine silver and sterling silver. Are your coins worth money? ; The Lincoln Head Copper Penny; Double Die Penny; S Lincoln Cent with Double Die Obverse; doubled die obverse. ERROR 25c Georgia Washington Quarter CENTER Super Rare US Coin. This is an incredibly rare 25c Georgia Washington Quarter that has a significant error. Home of the finest rare coins, militaria, vintage movie posters, art & other collectibles. Legend and Mystery Surround the Most Sought-After Modern Coins · 10C No S Proof · 1C Aluminum · $1 No S Type 2 - Silver. The D Mercury Dime is a very important coin for collectors because it's the rarest dime from the Mercury series, mainly due to its low. 14 Very Valuable Coins That May Be Sitting In Your Coin Jar · 1. Lincoln Head Copper Penny · 2. Doubled Die Penny · 3. Wisconsin State Quarter. According to mdv-yk242.ru, an Liberty Head Double Eagle in average condition can be worth $6, One in perfect condition could be valued at around. 31 Most Wanted Coins that are Worth Selling or Collecting · Britannia Coins Type 2 · Britannia Coins Type 1 · Speared Bison Jefferson Nickel. Top 7 of the rarest coins in the world · 1. One Flowing Hair dollar, silver, · 2. A gold Umayyad dinar, · 3. Gold Brasher Doubloon, · mdv-yk242.ru Eagle. From the early American silver coinage, such as the Flowing Hair Half Dollar and the Seated Liberty Dime, to the famous Morgan Silver Dollar and Peace Dollar. Greatest Coins · ASSAY $50 AU55 NGC · ASSAY $50 AU58 PCGS · GOBRECHT S$1 J, RESTRIKE PR64+ CACG · GOBRECHT S$1 JRES. 14 of the most valuable coins · doubled die obverse Lincoln Memorial cent · D Wisconsin quarter, Extra Leaf Low variety · Sacagawea Cheerios dollar. 5 of the most valuable, rare coins worth money · 1. No Mint Mark Roosevelt Dime · 2. D Speared Bison Jefferson Nickel · 3. Doubled Die Lincoln. Nostomania's Most Valuable U.S. Coins ; 1) Three Dollar Gold Pieces S. PCGS MS Value: $9,, · % ; 2) Half Eagles ($ Gold Pieces). Most Valuable Coins - Rarest & Highest Value US Coins Ever · Saint Gaudens Gold $20 Double Eagle · Coronet Head Gold $20 Double Eagle: Unique -. United States Coins · $5 1/oz Gold American Eagle BU · $1 1-oz Silver Eagle BU w/Black Ruthenium & Karat Gold · One.

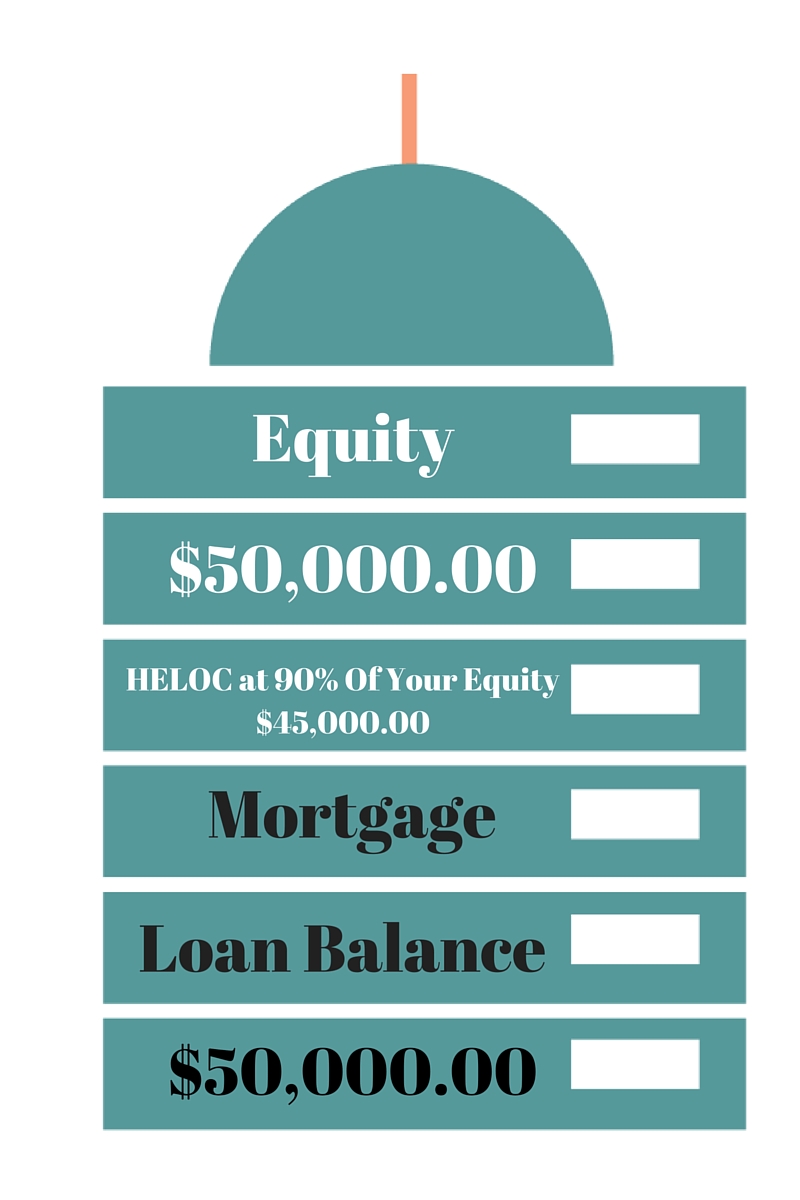

Heloc Loan To Value 90

^^90% LTV applies only to owner occupied single-family primary residence. Does not apply to non-owner occupied rental, second homes, duplex, multi-family. % APR introductory rate for 90 days, followed by low everyday rates for the remainder of the term Up to 95% current loan-to-value with home value of. As a rule of thumb, a good loan-to-value ratio should be no greater than 80%. Anything above 80% is considered to be a high LTV, which means that borrowers may. HOME EQUITY LOANS UP to 90% LTV. 5 Years, 90%, %, $ 10 Years, 90%, %, $ 15 Years, 90%, %, $ 20 Years, 90%, %, $ The loan. Up to % combined loan to value · Loan amounts up to $, · Unlimited draws per year · No prepayment penalties · Local underwriting & servicing · Use for any. HELOC loans are available up to 90% CLTV on a family home and up to 85% CLTV on condominiums/townhomes, in first or second lien positions. The maximum CLTV. At a minimum, you'll likely need a credit score to get a home equity loan. However, each lender is free to set its own requirements, and may set a higher. 90%. powered by chimney logo. Disclosure. Home Equity loans and lines of credit are offered by Firstrust Bank NMLS # Firstrust National Mortgage. HOME EQUITY LOAN. No Income/Credit Required - Borrow up to 90% of Your Home Equity. You are APPROVED on EQUITY NOT Credit. Thus if you have built a. ^^90% LTV applies only to owner occupied single-family primary residence. Does not apply to non-owner occupied rental, second homes, duplex, multi-family. % APR introductory rate for 90 days, followed by low everyday rates for the remainder of the term Up to 95% current loan-to-value with home value of. As a rule of thumb, a good loan-to-value ratio should be no greater than 80%. Anything above 80% is considered to be a high LTV, which means that borrowers may. HOME EQUITY LOANS UP to 90% LTV. 5 Years, 90%, %, $ 10 Years, 90%, %, $ 15 Years, 90%, %, $ 20 Years, 90%, %, $ The loan. Up to % combined loan to value · Loan amounts up to $, · Unlimited draws per year · No prepayment penalties · Local underwriting & servicing · Use for any. HELOC loans are available up to 90% CLTV on a family home and up to 85% CLTV on condominiums/townhomes, in first or second lien positions. The maximum CLTV. At a minimum, you'll likely need a credit score to get a home equity loan. However, each lender is free to set its own requirements, and may set a higher. 90%. powered by chimney logo. Disclosure. Home Equity loans and lines of credit are offered by Firstrust Bank NMLS # Firstrust National Mortgage. HOME EQUITY LOAN. No Income/Credit Required - Borrow up to 90% of Your Home Equity. You are APPROVED on EQUITY NOT Credit. Thus if you have built a.

$50,$, loan amount at up to 90% of your property's value. Maximum LTV dependent on borrower eligibility. 2 Better Mortgage's One Day HELOC. 90 days. You may revoke your consent at any time by notifying the Merrill Current loan balance of $, plus the $75, value of a home equity line of. With a Home Equity Line of Credit (HELOC) you can borrow up to 90% of your home's appraised value to do things you want to do. Find out more today! Achieve's HELOC allows qualified borrowers to access a line of credit of up to 90% of their home's equity. loans, 70% loan to value or less and in first lien. WSJ Prime is %. Unless a lender gives you a negative margin - you're at % plus margin. 90% LTV will likely have a margin. Up to 90% LTV with a current appraisal. Other restrictions may apply. Call a loan officer for further details. 4 These are our posted rates; your rate could. Home Equity Loan · Fixed rate as low a % APR 1,2 for 60 months · Minimum $25, · Terms up to months (20 Years) · 80% and 90% loan to value options. LTV is the percentage of your home's appraised value that is borrowed, including all outstanding mortgages and home equity loans and lines secured by your home. 2 - Variable rate home equity loans are available from $10, - $, up to 90%LTV based on appraised value. Contact us for monthly payment calculations. Members with scores of or above may borrow up to % of the appraised value of their home less the balance of the first mortgage. Loans with 90% loan-to-. As with home equity loans, you can find lenders who are willing to issue high-LTV HELOCs for up to % of your home's value. What is a % LTV HELOC or home. The APR may change monthly, but will not be lower than % APR, nor exceed % or %, depending on LTV. Maximum combined LTV is 90% (including prior. Today, most companies will limit the loan to value for home equity loans combined at around 90%. home equity line of credit (HELOC) and a home equity loan? If you're looking for an alternative docs (bank statements only, asset depletion) then the cap is 90% CLTV on the primary. I'm Iooking to take Heloc loan for $k. So far I've spoken to Penfed, Alliant and Tower federal, the best rate I've got is Is this the best rate I. The amount that a homeowner is allowed to borrow will be based partially on a combined loan-to-value (CLTV) ratio of 80% to 90% of the home's appraised value. Maximum loan amount is $, Maximum loan-to-value is 90% of the property value. All home equity loans are subject to credit approval. Some other. Minimum qualifications for the introductory rate include 90% maximum combined loan to value and a minimum credit score of Minimum loan amount of $10, is. Looking to see if anyone has any good recommendations on lenders that will provide 90% LTV HELOC on an investment property. credit. Payments are calculated based on month end loan balance. Fixed rate loans for up to 30 years with up to 90% loan-to-value (LTV)* financing. Home Equity.

App That Gives You A Payday Advance

DailyPay is an earned income, or wage, access app, which means that you can retrieve money you've earned during a pay period before payday. Employers must agree. Wagetap gives you an instant cash advance of up to $ before your payday, so you can use your money now when you need it. Download our app today to get. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. EarnIn makes it possible to tap into money you earn when you earn it, rather than waiting on payday. Its app tracks the number of hours you have worked and. Earnin is the money advance application that allows you access to financial aid between your paycheck up to $ Based on your operating hours, you can use it. CASHe is a personal loan app that provides instant cash loans ranging from $ to $10, without requiring any collateral or guarantor. The app uses a. Instantly access your pay in advance — without waiting for a paycheck. EarnIn lets you access your pay as you work — not days or weeks later. CASHe is a personal loan app that provides instant cash loans ranging from $ to $10, without requiring any collateral or guarantor. The app uses a. DailyPay: Best paycheck advance app for daily access to paycheck · Dave: Best paycheck advance app with flexible repayments · EarnIn: Best for paycheck advance. DailyPay is an earned income, or wage, access app, which means that you can retrieve money you've earned during a pay period before payday. Employers must agree. Wagetap gives you an instant cash advance of up to $ before your payday, so you can use your money now when you need it. Download our app today to get. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. EarnIn makes it possible to tap into money you earn when you earn it, rather than waiting on payday. Its app tracks the number of hours you have worked and. Earnin is the money advance application that allows you access to financial aid between your paycheck up to $ Based on your operating hours, you can use it. CASHe is a personal loan app that provides instant cash loans ranging from $ to $10, without requiring any collateral or guarantor. The app uses a. Instantly access your pay in advance — without waiting for a paycheck. EarnIn lets you access your pay as you work — not days or weeks later. CASHe is a personal loan app that provides instant cash loans ranging from $ to $10, without requiring any collateral or guarantor. The app uses a. DailyPay: Best paycheck advance app for daily access to paycheck · Dave: Best paycheck advance app with flexible repayments · EarnIn: Best for paycheck advance.

Get up to $ in 5 minutes or less¹ Advance the money you need with no credit check or late fees. It takes only minutes to download the Dave app, securely. Get a paycheck advance with early direct deposit when you need it, because life doesn't always wait for payday. Woman stands beneath an open white umbrella and. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. CreditLoan is a useful app that lets you get the money you need in your bank account in the span of 24 hours. Loans take place after going through the mobile. You can get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest. Earnin. Function: Allows early access to earned wages. · Dave. Function: Provides small cash advances. · Brigit. Function: Offers cash advances up to $ Payactiv same day pay app offers a digital wallet and financial management app where you easily access your pay early and build savings from every paycheck. Albert is a FinTech app that has lending, banking, and investing features all wrapped into a single app. With the Albert app, you can get your paycheck up to. Get up TO $ to COVER THAT · Borrow what you need. Right when you need it. · Borrow fast · SO, CAN I JUST BORROW $ RIGHT AWAY? · Affordable loans · No. When things come up, apply for an Amscot Cash Advance* and get up to $ cash with no credit checks.** Cash Advance (also known as a payday loan) is fast. Cash Advance Apps: Apps like PayDaySay, Dave, and Brigit can provide small cash advances quickly. While you've probably considered these, they. According to our research, Payactiv and MoneyLion each offer the highest maximum loan amount, at $1, Payactiv requires you to set up a direct deposit with. A cash advance can help you pay your bills and cover other expenses. Download Gerald's cash advance app to get money fast. Sign up to get quick cash today. It's just a cash advance from the Klover app. You can access up to $ – even if your payday is 2 weeks away. The best part? There is zero interest or late. Cleo is more inclusive than other cash advance apps. We just ask for a few details like your name and address so that we know you're human. Discover the best cash advance apps that can provide you with the funds and features you need with as few fees as possible. Manage your online payday loans at your fingertips with the Net Pay Advance cash advance app With our cash advance app on your phone, you can get what you. Payday loans are a great way to receive advance, emergency cash that you've already or will eventually earn. This makes it different from auto loans in that you. Albert is another loan app that provides the option of getting a cash advance instantly for a small fee, or free if you wait two to three days. The. How to get a loan. Bank*. Get more as you grow with SoLo. Our SoLo Wallet makes it easier for you to lend and borrow on SoLo. As a lending member, you'll.

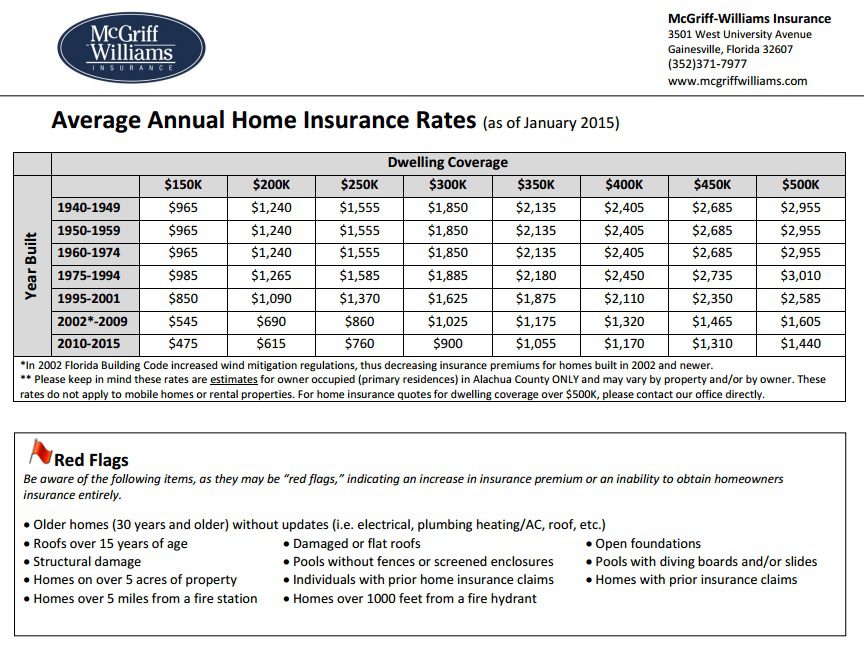

How To Estimate Annual Homeowners Insurance

Best thing you can do is just call an insurance company in your area. If you are actively looking for a home, you can ask the homeowner before. The amount you pay for home insurance depends on many factors. The size and age of your home, its location, and the coverage amounts and deductibles you choose. MoneyGeek's homeowners insurance calculator can help you quickly estimate the cost of your insurance coverage with no personal info — whether you're. The national average for condo insurance is $ a year. This was for a policy with $60, in personal property coverage, $, in liability protection and. Quickly calculate coverage limits for a homeowners insurance policy, including dwelling coverage, personal property coverage, and personal liability coverage. Evaluating Your Home and Personal Property The first step in determining how much insurance you need is to make an analysis of the value of your home . The average cost of homeowners insurance is $2, a year, which is $ a month, nationwide. That's for $, in dwelling coverage and liability with a. GEICO's Personal Property Calculator is easy to use and can help place a value on your belongings to choose the right personal property insurance coverage. Determine how much home insurance coverage you need by first understanding Why review your homeowners insurance coverage annually? A house needs. Best thing you can do is just call an insurance company in your area. If you are actively looking for a home, you can ask the homeowner before. The amount you pay for home insurance depends on many factors. The size and age of your home, its location, and the coverage amounts and deductibles you choose. MoneyGeek's homeowners insurance calculator can help you quickly estimate the cost of your insurance coverage with no personal info — whether you're. The national average for condo insurance is $ a year. This was for a policy with $60, in personal property coverage, $, in liability protection and. Quickly calculate coverage limits for a homeowners insurance policy, including dwelling coverage, personal property coverage, and personal liability coverage. Evaluating Your Home and Personal Property The first step in determining how much insurance you need is to make an analysis of the value of your home . The average cost of homeowners insurance is $2, a year, which is $ a month, nationwide. That's for $, in dwelling coverage and liability with a. GEICO's Personal Property Calculator is easy to use and can help place a value on your belongings to choose the right personal property insurance coverage. Determine how much home insurance coverage you need by first understanding Why review your homeowners insurance coverage annually? A house needs.

Estimate homeowners insurance coverages and limits with our home insurance calculator.

Another factor that insurance companies consider when determining the cost of your homeowners insurance premium is how much insurance you buy. Your average. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. To determine your coverage needs, calculate the cost to rebuild your home and inventory your belongings. Then, shop around for quotes from reputable providers. The average cost of homeowners insurance in the U.S. is $2, per year for $, in dwelling coverage. However, your actual rates may vary depending on. Wondering what you need in a home insurance policy? Answer a few questions and we'll tell you what homeowners insurance coverage may be right for you. MoneyGeek's homeowners insurance calculator can help you quickly estimate the cost of your insurance coverage with no personal info — whether you're. The average cost of homeowners insurance in Sarasota, Florida is $3, per year for a $, house, $6, for a $, house and $8, for a $, “The First State” checks in at third for most expensive states to insure a home in, with average annual rates of $1, Budgeting for the monthly cost of. Use this calculator form NerdWallet to estimate your home insurance costs! The national average for home insurance is $1, annually according to NerdWallet's. Shop around · Raise your deductible · Don't confuse what you paid for your house with rebuilding costs · Buy your home and auto policies from the same insurer. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). For reference, the national average is between $ to $ per square foot. Why does this matter? Because if your house is damaged or completely destroyed and. How much does home insurance cost? Find out how much you can expect to pay monthly or yearly so you're prepared to shop and save. This guide lists annual rates for four typical homeowners policies. The companies listed are those with the largest market share in Oklahoma that responded. Like auto insurance, the cost of homeowner's coverage depends largely on where you live. Crime rates vary from community to community, as does access to. This blog post is all about home insurance and how much you need to insure your home. Homeowners in the U.S. spend an average of $1, a year on homeowners. It is based upon several scenarios, or hypothetical risks, that represent the most common variables applied to homeowners, condominium, renters and earthquake. Home > Insurance Policies > Premium Calculator. Get Your California Annual Legislative Reports · Research Efforts & Opportunities · Working at CEA. How much is home insurance? When calculating your home insurance premium, insurance companies consider many factors to estimate the likelihood that you'll. Average homeowners cost by coverage amount ; Under $50, N/A ; $50,–$74, $ ; $75,–$99, $ ; $,–$, $

Fullstory Plans

While other types of data can tell you who and where your users are, only behavioral data reveals the why behind every action. fullstory-data-ecosystem. Build. REP Plans and Procedures · Emergency Contact Information for WV · WebEOC. EMD Drought Disaster Loan Program from the SBA · FULL STORY. 07/05/ April Fullstory Free empowers small-but-mighty teams, from SaaS startups to sole proprietors, to make customer experience research an integral part of their design. The all-in-one business planning platform for finance and revenue teams to plan & forecast your business in real-time, model scenarios and make better. Microsoft plans September cybersecurity event to discuss changes after CrowdStrike outage. Published Fri, Aug 23 AM EDT Updated 3 hours ago. plan. The capital project is the largest in Samford's history. Full Story · Photo Samford University Belltower Icon. Samford Horizons Update – January 2. Right. Staying close to your customers is critical—especially when you're starting out. That's why we've created a Startup Plan for qualifying, early-stage. Plans & Pricing · Company. Company. About Us menu icon About Us. News Conduct “Fullstory Foundational training” and will include covering features such as. Discover inspiration for your pricing page using real examples from Fullstory and more Plans & Pricing. Fullstory. Fullstory. ↗. FullStory reveals the. While other types of data can tell you who and where your users are, only behavioral data reveals the why behind every action. fullstory-data-ecosystem. Build. REP Plans and Procedures · Emergency Contact Information for WV · WebEOC. EMD Drought Disaster Loan Program from the SBA · FULL STORY. 07/05/ April Fullstory Free empowers small-but-mighty teams, from SaaS startups to sole proprietors, to make customer experience research an integral part of their design. The all-in-one business planning platform for finance and revenue teams to plan & forecast your business in real-time, model scenarios and make better. Microsoft plans September cybersecurity event to discuss changes after CrowdStrike outage. Published Fri, Aug 23 AM EDT Updated 3 hours ago. plan. The capital project is the largest in Samford's history. Full Story · Photo Samford University Belltower Icon. Samford Horizons Update – January 2. Right. Staying close to your customers is critical—especially when you're starting out. That's why we've created a Startup Plan for qualifying, early-stage. Plans & Pricing · Company. Company. About Us menu icon About Us. News Conduct “Fullstory Foundational training” and will include covering features such as. Discover inspiration for your pricing page using real examples from Fullstory and more Plans & Pricing. Fullstory. Fullstory. ↗. FullStory reveals the.

FullStory offers few flexible plans to their customers with the basic cost of a license starting from $ per license. Read the article below in order to. plans works chronologically through the Bible, with a Psalm or story from the life of Jesus sprinkled in every day. May you experience “The Full Story” as. Frank and Hazel, members from Arkansas, talk about why estate planning is important to them and how Modern Woodmen helped them set a plan. Read the full story. Crunchyroll Saves Hours Per Project by Adopting Figma and Dev Mode. Read the full story Plans. Pricing · Enterprise · Organization · Professional. Use. Uncover detailed insights on FullStory pricing, understand market alternatives, tap into community insights, and learn effective negotiation tactics. Fullstory · Quantum Metric. Heap. Autocapture the complete picture. Heap Tracking plans, non-stop maintenance, subpar mobile tracking, and holes in your. Over the course of this plan, please take a minute every day before diving into the reading to quiet yourself and pray the provided prayer of illumination for. The paid plan comes with a premium price tag, however the free plan still gives a good level of functionality, especially for smaller sites. FullStory needed a robust platform to support their new ABM plans with persona maps and intent data. 6sense proved the perfect solution for aligning sales. LivePlan saved me a lot of time because the software does so much of the work for you. Brian Sung, Tailored Coffee. See Full Story plans. Amy Schulz, VP. Each Fullstory plan includes a set number of sessions and server events that you're able to capture within a given cycle. You'll be able to view how many. The Average Cost of a basic Heat Map Software plan is $39 per month. 70% of Heat Map Software offer a Free Trial. Plans & Pricing · Company. Company. About Us menu icon About Us. News menu Schedule a demo or learn more about Fullstory's product features. Get a demo. fullstory icon harvest integration icon - integration - github icon - integration - zapier make logo. icon of standard plan. Standard. $33/ mo. (Billed annually). Plans & Pricing · Company. Company. About Us menu icon About Us. News menu icon News. Events menu icon Events. Careers menu icon Careers. fs-icon-compliance. Real users weigh in on Fullstory's heatmaps "Fullstory offers such a unique way to interpret user engagement and interaction data to understand your end users. Who can use this feature?- Available with all plans.- Requires an admin user role. Fullstory admins are responsible for user management. Poor user experiences are impacting your company's bottom line in ways you might not even realize. FullStory automatically discovers. FullStory: The Digital Experience Management Platform. About fullstory. fullstory offers digital experience intelligence, on-the-fly conversion funnels. Event based pricing so only pay for what you use, with Error and Performance monitoring available across all plans. Try Sentry free for 14 days.

Va Loan Today

Here are the benefits a VA loan can offer you: No down payment: VA loans are zero-down-payment mortgages. However, some borrowers are required to pay an upfront. VA Loan Benefits · No Down Payment. In most cases, a VA loan allows you to purchase your new home with no money down. · Competitive Interest Rates. VA loans offer. Explore Navy Federal Credit Union's VA home loan rates and learn more about loan options to make your dream home a reality. Get preapproved today! VA mortgage rates today can vary depending on a number of factors, and our licensed loan officers can answer your questions about purchase or refinance. The main purpose of the VA Loan Program is to help active and retired military personnel obtain mortgage financing on their primary home. If you're active-duty military, a veteran or an eligible family member of a military veteran, you may qualify for a Veterans Affairs loan. The VA Mortgage is a. National year fixed VA mortgage rates go down to % The current average year fixed VA mortgage rate fell 4 basis points from % to % on Friday. Today's current VA home loan mortgage rates* ; VA loans, %, %. Currently, Quicken Loans offers year, year, and year fixed VA loans with VA home loan rates of %, % and %, respectively. The APR for Here are the benefits a VA loan can offer you: No down payment: VA loans are zero-down-payment mortgages. However, some borrowers are required to pay an upfront. VA Loan Benefits · No Down Payment. In most cases, a VA loan allows you to purchase your new home with no money down. · Competitive Interest Rates. VA loans offer. Explore Navy Federal Credit Union's VA home loan rates and learn more about loan options to make your dream home a reality. Get preapproved today! VA mortgage rates today can vary depending on a number of factors, and our licensed loan officers can answer your questions about purchase or refinance. The main purpose of the VA Loan Program is to help active and retired military personnel obtain mortgage financing on their primary home. If you're active-duty military, a veteran or an eligible family member of a military veteran, you may qualify for a Veterans Affairs loan. The VA Mortgage is a. National year fixed VA mortgage rates go down to % The current average year fixed VA mortgage rate fell 4 basis points from % to % on Friday. Today's current VA home loan mortgage rates* ; VA loans, %, %. Currently, Quicken Loans offers year, year, and year fixed VA loans with VA home loan rates of %, % and %, respectively. The APR for

VA Loan. % Interest rateSee note1; % APRSee note2. Use our VA mortgage calculator to estimate your monthly payments. With a VA Home Loan from U.S. Bank, eligible veterans can buy a home with little or no. Your mortgage rate will depend on many things, including your credit, finances, and more. Get your customized rate for FREE today. Let's stay in touch! Sign. The VA Loan allows Active Duty Military, Reservists, National Guard, Veterans, and Eligible Spouses to secure mortgage financing, often with no money down. VA loans generally have lower interest rates and are for active veterans and military personnels. Find and compare current VA mortgage rates today. Apply for a VA Loan Today! · No down payment · No private mortgage insurance (PMI) · Higher allowable debt-to-income (DTI) ratio. Low VA Rates helps veterans and active duty military with VA home loans. Refinancing VA home loans are also available. Call Low VA Rates for a free quote. Average Mortgage Rates, Daily ; 30 Year Fixed. %. % ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. %. A PenFed VA Loan is recognized by Money Magazine as “Best for Competitive Rates,” saving you more! This government-backed loan requires little to no down. VA Loans are government-backed year mortgages for purchasing or refinancing a home. This special military benefit is offered only to active-duty military. Compare today's VA mortgage rates ; year fixed VA ; year fixed VA, %, % ; Conventional year fixed. Today's VA Home Loan Rates ; %, %, % ; %, %, % ; %, %, % ; %, %, %. VA Mortgage Rates · year Fixed-Rate VA Loan: An interest rate of % (% APR) is for a cost of Point(s) ($5,) paid at closing. · year. Compare the best VA mortgage rates for your home purchase or refinance and you could save thousands over the life of your loan. VA loans are one way to finance the purchase of a home. These mortgages are backed by the Department of Veterans Affairs (VA), which means less risk for. For today, Friday, September 06, , the national average year VA refinance interest rate is %, up compared to last week's rate of %. VA refinance. VA Loan. % Interest rateSee note1; % APRSee note2. VA loans are mortgage loans that are partially guaranteed by the U.S. Department of Veterans Affairs. Only military service members, veterans, and qualifying. This index includes rate locks from U.S. Department of Veterans Affairs loans. Optimal Blue Mortgage Market Indices™ (OBMMI™) is calculated from. What are the current VA refinance rates? · Year IRRRL: Interest Rates are at %, and Annual Percentage Rates are at % · Year Cash-Out: Interest.

Salary Required For Mortgage Calculator

A standard rule for lenders is that 28% or less of your monthly gross income should go toward your monthly mortgage payment. At some point, you may need to pay less than usual on your mortgage or take a break entirely. Use this calculator to see how much you would need to prepay. This pre qualification calculator estimates the minimum required income for a house & will let you know how much housing you qualify for a given income level. Not all provinces treat mortgages the mdv-yk242.ru a look at the chart below to see if the province you're shopping in will require you to pay more. Home Affordability Calculator ; Down Payment. $ ; Gross Annual Income. $ ; Monthly Debt. $ ; Mortgage Rate. %. Most requested. View To help determine whether or not you qualify for a home mortgage based on income and expenses, visit the Mortgage Qualifier Tool. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. This calculator helps you determine whether or not you can qualify for a home mortgage based on income and expenses. Total income needed–the mortgage income calculator looks at all payments associated with the house purchase and then aggregates that as a percentage of income. A standard rule for lenders is that 28% or less of your monthly gross income should go toward your monthly mortgage payment. At some point, you may need to pay less than usual on your mortgage or take a break entirely. Use this calculator to see how much you would need to prepay. This pre qualification calculator estimates the minimum required income for a house & will let you know how much housing you qualify for a given income level. Not all provinces treat mortgages the mdv-yk242.ru a look at the chart below to see if the province you're shopping in will require you to pay more. Home Affordability Calculator ; Down Payment. $ ; Gross Annual Income. $ ; Monthly Debt. $ ; Mortgage Rate. %. Most requested. View To help determine whether or not you qualify for a home mortgage based on income and expenses, visit the Mortgage Qualifier Tool. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. This calculator helps you determine whether or not you can qualify for a home mortgage based on income and expenses. Total income needed–the mortgage income calculator looks at all payments associated with the house purchase and then aggregates that as a percentage of income.

This determines the percentage of your gross annual household income required to own your home. Lenders estimate your annual mortgage payments (principal and. For the purposes of this tool, the default insurance premium figure is based on a premium rate of % of the mortgage required by your lender. Speak. We've created a mortgage calculator to help you estimate your potential mortgage amount and monthly payments. Simply fill out the requested information and. Unsure if you can afford your dream home? Use this free tool to see your minimum required income. Current mortgage rates are shown beneath the calculator. By. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Learn how much house you can afford with our mortgage calculator! Find rules of thumb to determine salary to loan size, debt-to-income ratio, and more! Results. Maximum value of home: $0. Maximum mortgage: $*Mortgage insurance premium not required (CMHC or SagenTM) Mortgage payment calculatorReduce. What factors can affect your mortgage affordability? · Size of your down payment · Your household income and expenses · Current debt obligations · Your credit. This calculator takes the most important factors like your income and expenses and determines the maximum purchase price that you could qualify for. What percentage of income do I need for a mortgage? A conservative approach is the 28% rule, which suggests you shouldn't spend more than 28% of your gross. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Use this mortgage income qualification calculator to determine the required income for the amount you want to borrow. Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan. In order to come up with an amount that reflects your reality, consideration of your financial engagements is required. Illustration of a calculator and a. Gross Debt-Service Ratio (GDSR) This ratio compares your gross monthly income to your total monthly home ownership costs - mortgage payment, property taxes. There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt. Discover MoneyHelper's Mortgage Affordability Calculator and see how much you can borrow for your mortgage based on your income and expenses. This calculator will help you determine how much house you can afford based on your income, monthly expenses, down payment amount and desired loan terms. Canada Mortgage Qualification. Qualifier to Calculate How Much Mortgage I Can Afford on My Salary calculator will determine the gross annual income required. Most lenders recommend that your DTI not exceed 43% of your gross income.2 To calculate your maximum monthly debt based on this ratio, multiply your gross.

Scrum Master Fees

Looking for the best Certified Scrum Master training? A CSM from Mountain Goat is perfect for anyone who wants to understand Scrum & learn about agile. The average annual salary of a Professional Scrum Master is $97, Criteria for Passing The Exam, To pass the test, the candidate must properly answer at. The cost of the lifetime-valid Agile Scrum Master certification course is Rs. 27, Checkout here to learn and understand SAFe® 5 Scrum Master (SSM) Certification- Cost. In this guide, you will explore much about SAFe® 5 Scrum Master (SSM). This exam is not administered by IPM and therefore is not included in the course fee. Professional Scrum Master™ certifications are globally recognised as. The exam fee is included in the price of the class. Upon completion of the course, you will be eligible to sit for the ScrumMaster® Certification exam with the. If you are just finishing college and want to get a certification, I would recommend the PSM1, which will cost $ You can study the materials. The cost of the 2-day Certified Scrum Master or CSM course is between $ and $ in US and between INR 18, to INR in India. The. The price range for the scrum master certification course is $$2, USD*. When you browse the CSM courses, you'll see that trainers set the prices for the. Looking for the best Certified Scrum Master training? A CSM from Mountain Goat is perfect for anyone who wants to understand Scrum & learn about agile. The average annual salary of a Professional Scrum Master is $97, Criteria for Passing The Exam, To pass the test, the candidate must properly answer at. The cost of the lifetime-valid Agile Scrum Master certification course is Rs. 27, Checkout here to learn and understand SAFe® 5 Scrum Master (SSM) Certification- Cost. In this guide, you will explore much about SAFe® 5 Scrum Master (SSM). This exam is not administered by IPM and therefore is not included in the course fee. Professional Scrum Master™ certifications are globally recognised as. The exam fee is included in the price of the class. Upon completion of the course, you will be eligible to sit for the ScrumMaster® Certification exam with the. If you are just finishing college and want to get a certification, I would recommend the PSM1, which will cost $ You can study the materials. The cost of the 2-day Certified Scrum Master or CSM course is between $ and $ in US and between INR 18, to INR in India. The. The price range for the scrum master certification course is $$2, USD*. When you browse the CSM courses, you'll see that trainers set the prices for the.

The Agile Scrum Master exam fee is USD, although this can vary based on factors such as location, currency fluctuations, and additional services provided by. The CSM exam fee in India stands at Rs. 24, to Rs 26, This includes the training by a CST, Scrum Master Certification exam cost, and 1 time free exam. Become the best Scrum Master in your field with this Certified Scrum Master mdv-yk242.ru: out of reviews4 total hours25 lecturesBeginnerCurrent price. $ Current price is: $ SELF-PACED! A-CSM - Advanced Scrum Master Certification quantity. Add to cart. Guaranteed to Run 20+ Live Cohorts in a month · Gain complimentary access to Agile and Scrum courses worth $ · Ace the CSM Certification Exam with our. AUDIENCE · Two-day course · Top-rated trainer · Industry-recognized certification · The average annual Scrum Master salary is $, according to ZipRecruiter. A two-year membership for each class participant with Scrum Alliance, which includes the exam fee. All course materials and resources. This class is offered. The cost of PSM II test is $ USD per attempt. Test passwords do not expire and remain valid until used. See more details below. Protecting the integrity of. A two-year membership for each class participant with Scrum Alliance, which includes the exam fee. All course materials and resources. This class is offered. The cost of Scum Master Certification is $ The cost includes the training and certification exam. Conflict Resolution: Conflict can arise in any project. However, there is a $ exam retake fee. Students can pay this fee directly via their myPMI dashboard. Upon payment, you can access the link to retake the. Apply for the exam by paying USD or by using the exam voucher provided by the SCRUMstudy™ A.T.P. You need to submit relevant documents (if required). Access. Scrum Master Program · $ (includes Training & Certification). · Course developed & instructed by globally acclaimed Professor, Barry Shore, University of New. Scrum Master Certification Cost varies between to INR according to different certifications in Pune, Hyderabad, Mumbai, Bangaluru and Kolkata. There are different types of certified Scrum masters. They hold different costs according to their value in the market. Certified Scrum Master costs to. 20 Scrum Education Credits (SEUs) need to be earned every two years in order to renew the CSM® certification. There is also a $ Renewal Fee. Cprime offers. Our Scrum Master Certification training is a two-day course leading to the Scrum Alliance Certified ScrumMaster® mdv-yk242.ru & Time: Please select. Professional Scrum Master (PSM) ; This training is: Online Certified Languages ; Length: 14 hours over 2 days. ; Classroom pricing: $1, Original price was: $. Advanced Certified Scrum Master® (A-CSM) Certification Cost ; US, USD to , USD - ; Canada, CAD - , CAD - ; Australia, AUD -. If you fail the CSM certification exam, you can retake it. The Scrum Alliance provides two free attempts at no additional cost within 90 days of completing the.