mdv-yk242.ru

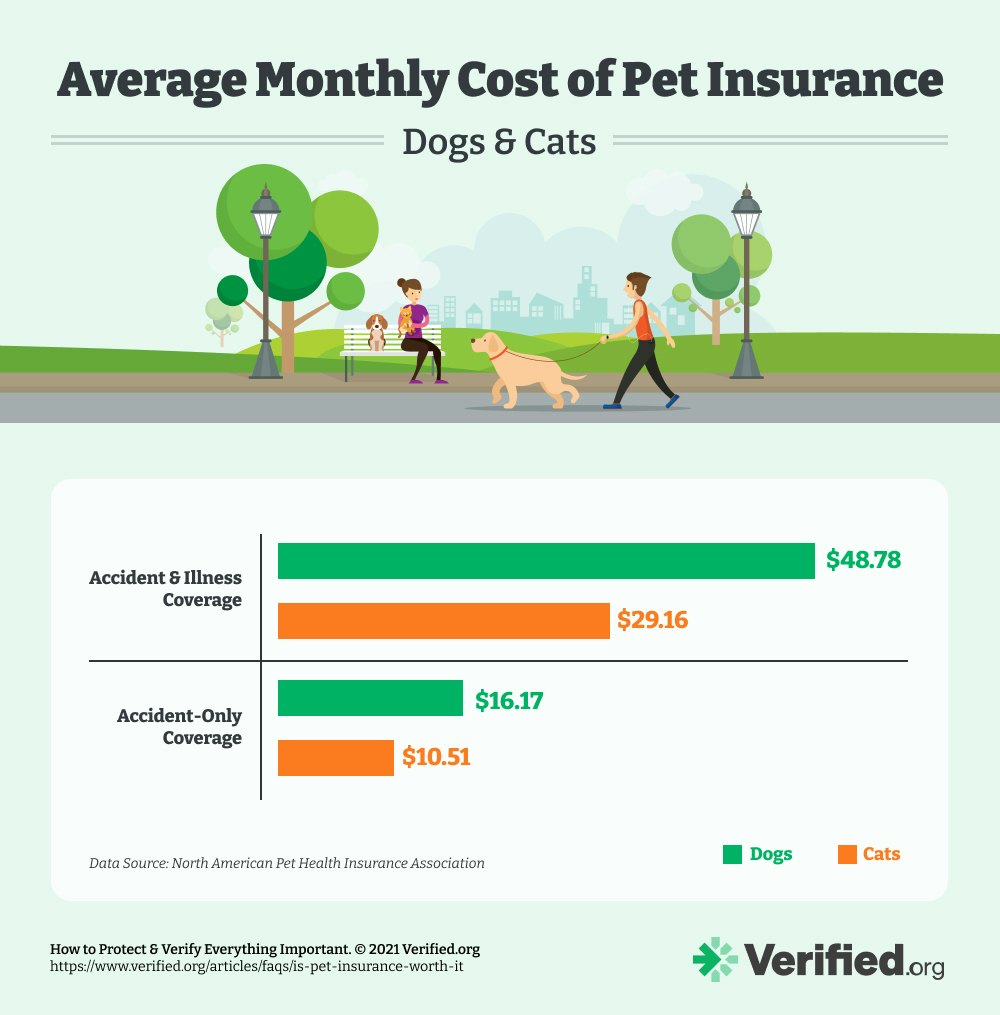

Market

How Much Is The Pet Insurance

The cost of pet insurance varies based on many factors. As with other insurance you may have, you'll likely pay an annual or monthly premium to keep your pet. The Accident Only pet insurance plan is only $10 or less a month, regardless of your dog or cat's age or breed. keyboard_arrow_down What isn't covered by pet. Our most popular plans are about $20/month. Call for a quote: How are my premiums determined? The average cost of an accident and illness pet policy was $ per month for a dog in , or $ per year, according to the North American Pet Health. The average monthly cost of pet insurance in New York is: $ for a kitten, $ for a 5-year-old cat, and $ for a year-old cat; $ for a. Nationwide protects more than 1,, pets · Complete coverage. · Complete confidence. · How pet insurance works · Frequently Asked Questions. The average cost of dog insurance hovers around $88 per month, according to quotes analyzed by Investopedia. But much like our canine companions, rates vary. On average, comprehensive coverage costs $ for dogs and $ for cats each year. These policies may exclude pets with pre-existing or genetic conditions. How much does pet insurance cost? With Fetch, the average cost of dog insurance is $35 per month and the average cost of cat insurance is $20 per month. But. The cost of pet insurance varies based on many factors. As with other insurance you may have, you'll likely pay an annual or monthly premium to keep your pet. The Accident Only pet insurance plan is only $10 or less a month, regardless of your dog or cat's age or breed. keyboard_arrow_down What isn't covered by pet. Our most popular plans are about $20/month. Call for a quote: How are my premiums determined? The average cost of an accident and illness pet policy was $ per month for a dog in , or $ per year, according to the North American Pet Health. The average monthly cost of pet insurance in New York is: $ for a kitten, $ for a 5-year-old cat, and $ for a year-old cat; $ for a. Nationwide protects more than 1,, pets · Complete coverage. · Complete confidence. · How pet insurance works · Frequently Asked Questions. The average cost of dog insurance hovers around $88 per month, according to quotes analyzed by Investopedia. But much like our canine companions, rates vary. On average, comprehensive coverage costs $ for dogs and $ for cats each year. These policies may exclude pets with pre-existing or genetic conditions. How much does pet insurance cost? With Fetch, the average cost of dog insurance is $35 per month and the average cost of cat insurance is $20 per month. But.

Pet insurance costs $55 per month on average for an unlimited accident and illness plan for a dog and about $47 per month for a cat. But how much you'll pay for. The GEICO Insurance Agency can help you get comprehensive pet insurance coverage for your dogs and cats. Get a free online quote and see how affordable pet. The average accident and illness plan pet insurance premium in was $ per month for dogs, and $ for cats. The average cost for pet insurance is $ per month for dogs and $ per month for cats. The species, breed, age, and location of. The average monthly cost of pet insurance in New York is: $ for a kitten, $ for a 5-year-old cat, and $ for a year-old cat; $ for a. The monthly premium depends on the type of coverage selected. Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet. How Progressive Pet Insurance by Pets Best compares · One annual deductible · Fast claims processing and payment · No upper age limits · Optional exam fee coverage. How Much Does Pet Insurance Cost on Average in the US? The average monthly pet insurance premium is $ for dogs and $ for cats, according to the. You can rest easy knowing your dogs and puppies are protected from head to tail with MetLife Pet Insurance. Starting at $15 a month. Enjoy unlimited payouts on covered cost. Your coverage won't be dropped no matter how many claims you file. Rated #1 by vets. Trupanion medical insurance. How much is pet insurance in New York? The average cost of pet insurance in New York is $92 a month for an accident and illness plan with unlimited coverage. Pet insurance reimburses 70%, 80%, 90%, or even % of unexpected veterinary costs depending on your plan. Pawlicy Advisor is a free service that will help you. Pay a known fixed cost to reduce the risk of a big cost. For me, I self-insure. But part of this is the type of pets I get. I've adopted animals. We love Figo! I am so happy with pet insurance because having a sick pet is scary enough. Not knowing how to pay to get the care your pet needs is even. How much is pet insurance for cats? According to data provided by NAPHIA for the year , the annual cost for cat owners is an average of $, while the. Pet owners trust Nationwide to protect more than 1,, pets · Pet insurance premiums starting at $25/mo. · Visit any licensed veterinarian in the United. How much does pet insurance cost? Most pet owners pay between $30 and $50 per month for their pet health plan, depending on your pet's age, species, breed and. Give yourself the freedom to focus on your pet's health — instead of how to pay for it — with affordable pet insurance. Understand pet insurance cost and. Premiums for pet health insurance are based primarily on your dog or cat's age, breed, location, and your plan's annual limit, deductible, and reimbursement. Pet health insurance helps you mitigate unexpected costs and manage vet bills so you're financially protected if something happens to your pet. How Much Does.

Withdraw Cash App

You can also use your Cash App Card at ATMs to withdraw cash up to the daily withdrawal limit of $ and weekly withdrawal limit of $ On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to Bank the transfer to bank button. Enter an amount and. You can use your Cash App Card to make ATM withdrawals with your Cash PIN at any ATM. We do not support withdrawing funds from your 'Savings' balance. Left your wallet behind and need cash? With Cardless Cash in the CommBank app, you can securely withdraw cash without your card or even arrange for someone else. When you choose “cash out,” then enter the amount and press “cash out” at the bottom, the options pop up: “standard (insert day of week here . Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. You can use your Cash App Card to get cash back at checkout and withdraw cash from ATMs, up to the following limits: $1, per day; $1, per ATM. Effective through January 8, Our ATM withdrawal fee is $ You may also be charged a fee by the ATM operator. If you receive $ or more in direct. Choose "Cash Out": Tap the "Cash Out" button to withdraw. Enter the Amount: Specify the amount you wish to withdraw from your Cash App account. You can also use your Cash App Card at ATMs to withdraw cash up to the daily withdrawal limit of $ and weekly withdrawal limit of $ On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to Bank the transfer to bank button. Enter an amount and. You can use your Cash App Card to make ATM withdrawals with your Cash PIN at any ATM. We do not support withdrawing funds from your 'Savings' balance. Left your wallet behind and need cash? With Cardless Cash in the CommBank app, you can securely withdraw cash without your card or even arrange for someone else. When you choose “cash out,” then enter the amount and press “cash out” at the bottom, the options pop up: “standard (insert day of week here . Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. You can use your Cash App Card to get cash back at checkout and withdraw cash from ATMs, up to the following limits: $1, per day; $1, per ATM. Effective through January 8, Our ATM withdrawal fee is $ You may also be charged a fee by the ATM operator. If you receive $ or more in direct. Choose "Cash Out": Tap the "Cash Out" button to withdraw. Enter the Amount: Specify the amount you wish to withdraw from your Cash App account.

You can withdraw your money to your external bank account at any time.

"Withdrawal limit: Unverified accounts can withdraw up to $ per transaction, $ per day, $1, per week, and $1, monthly from ATMs or. Any additional withdrawals during the same 31 day period will be $, plus any operator fees. $ Information. Customer service (in-app), $0. Customer. withdrawals. Can I change the name on my Square Debit Card? The Does Square Debit Card work with peer-to-peer payment providers (e.g. Cash App, Venmo)?. Withdrawing cash from a cardless ATM can generally be done in these few easy steps: Sign in to your bank's app and choose the account you want to withdraw from. Cash App provides unlimited free withdrawals, including ATM operator fees, for customers who get $ (or more) in paychecks directly deposited into their. Please note: If cash is not picked up within 24 hours the Mobile Banking app setup for your ATM withdrawal will expire. Setting up your withdrawal in the Mobile. See this: “Retail stores that you can load your Cash App card include Walmart, CVS, Walgreens, Rite Aid, and 7-Eleven. Ask the Cashier to. With this feature, you can withdraw money from an ATM with your Google Pay app without the use of your debit card. When you select the option “UPI Cash. Similarly, it offers its users a debit card, which can be uniquely personalized, and allows for ATM withdrawals too. And on top of all this, Cash App also. Check Your Withdrawal Transfer Status · Tap the Activity tab on your Cash App home screen · Select the transaction · Press the button at the bottom of the. Just enter your Cash PIN and choose a cash-back amount. Receiving cash back does count towards your ATM withdrawal limits. Contact us. Cash App does offer a way to get some free ATM withdrawals, though. Receive qualifying deposits of $ or more in your Cash App account, and you'll be. Cash App allows ATM withdrawals with its Cash Card — a Visa debit card linked to your Cash App balance. The ATM withdrawal limit for the Cash. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Bitcoin Withdrawals · Toggle from USD to BTC by tapping “USD” on your Cash App home screen. · Select Bitcoin · Enter the amount of Bitcoin you want to withdraw. What is the Cash App daily limit? Cash App doesn't have a daily limit. There is a day limit of $1, for sending and receiving funds for unverified accounts. If this is your preferred withdrawal method, it is indeed possible to withdraw money from FanDuel to Cash App. While there are limitations to the Cash App as a. Cashing Out · Tap your Cash App balance in the lower left to open the Banking tab · Tap the Cash Out button · Tap to enter the amount of cash you want to withdraw. Cash App instantly waives its fee for in-network ATM withdrawals for customers who receive $ (or more) in paycheck direct deposits in a given.

Can A Traditional Ira Be Rolled Into A 401k

You can roll over funds from a (a) into a qualified (a) plan with another employer, (if the employer allows rollovers), as well as into a traditional IRA. If your new employer doesn't offer a (k), or you don't like their current plan, you can roll your (k) into a traditional IRA or a Roth IRA. Both are. You can't borrow against a Roth IRA as you can with a (k). Any Traditional (k) assets that are rolled into a Roth IRA are subject to taxes at the time of. You can roll over your old employer-sponsored plan account to a traditional IRA or a Roth IRA. You can roll pre-tax and after-tax assets into a traditional IRA. Most pre-retirement payments you receive from a retirement plan or IRA can be “rolled over” by depositing the payment in another retirement plan or IRA. VG likely understands that rollover of IRA basis is not allowed, but they simply do not have forms or procedures in place to properly issue the corrective. Yes. You can roll over almost any type of employer-sponsored retirement plan, such as a (k), (b), or into a Vanguard IRA. You can roll a (K) into an IRA in two ways: through a direct rollover or an indirect rollover. Let us clarify direct vs. indirect rollovers: With a direct. Can I roll over my IRA into my retirement plan at work? You can roll over your IRA into a qualified retirement plan (for example, a (k) plan), assuming. You can roll over funds from a (a) into a qualified (a) plan with another employer, (if the employer allows rollovers), as well as into a traditional IRA. If your new employer doesn't offer a (k), or you don't like their current plan, you can roll your (k) into a traditional IRA or a Roth IRA. Both are. You can't borrow against a Roth IRA as you can with a (k). Any Traditional (k) assets that are rolled into a Roth IRA are subject to taxes at the time of. You can roll over your old employer-sponsored plan account to a traditional IRA or a Roth IRA. You can roll pre-tax and after-tax assets into a traditional IRA. Most pre-retirement payments you receive from a retirement plan or IRA can be “rolled over” by depositing the payment in another retirement plan or IRA. VG likely understands that rollover of IRA basis is not allowed, but they simply do not have forms or procedures in place to properly issue the corrective. Yes. You can roll over almost any type of employer-sponsored retirement plan, such as a (k), (b), or into a Vanguard IRA. You can roll a (K) into an IRA in two ways: through a direct rollover or an indirect rollover. Let us clarify direct vs. indirect rollovers: With a direct. Can I roll over my IRA into my retirement plan at work? You can roll over your IRA into a qualified retirement plan (for example, a (k) plan), assuming.

Rolling over a (k) is an opportunity to simplify your finances. By bringing your old (k)s and IRAs together, you can manage your retirement savings. Moving a Roth (k) balance to a Roth IRA has no tax impact, nor does rolling a traditional (k) balance into a traditional IRA. However, if you roll your. You can roll it over into an IRA, leave it with the employer plan, or cash out. Before transferring your retirement assets to an IRA rollover, be sure to. You can move into your traditional TSP account both transfers and rollovers of tax-deferred money from traditional IRAs, SIMPLE IRAs and eligible employer plans. Under current law, you cannot transfer Roth IRA assets into a Roth (k) or Roth b. The benefits of doing so might be limited anyway, with the ability to. A rollover usually doesn't trigger tax complications, as long as you move a regular (k) into a traditional IRA or a Roth (k) into a Roth IRA. Internal. You may gain tax benefits by converting all or a portion of your Traditional IRA or eligible rollover distributions from your QRP into a Roth IRA. Please verify. You can choose to open a new Roth or traditional IRA, or you can roll into an existing IRA. Move money. Fund your IRA. You can roll it over into an IRA, leave it with the employer plan, or cash out. Before transferring your retirement assets to an IRA rollover, be sure to. Most plans qualify. You can do a tax-free direct rollover from most employer-sponsored plans including k, b, plans, and SEP IRAs. While rolling over. When you leave a job, you can leave your (k) where it is, roll it over into your new employer's (k) plan, roll it over into an IRA, or cash it out. To. You can also convert traditional (k) balances to a Roth IRA. Generally, you'll only be able to transfer a (k) to a Roth IRA if you are rolling over your. Many people roll over their (k) savings when they change jobs or retire. However, numerous (k) plans allow employees to transfer funds to an IRA while. Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over all or a portion of the assets to a traditional IRA. INVESTING GOALSExplore rolling over your (k) We can help you move over a (k) or other eligible retirement account(s) into an Individual Retirement. When this happens there are options for your k funds and one is to conduct a rollover into an Individual Retirement Account (IRA). The IRS allows you to. 2. (k) rollover to a traditional IRA · You can make additional contributions past the age of 70½ if you are earning income. · You will have a wider range of. If you roll over your (k) distribution directly to a traditional IRA or You can even put the full value of the (k) in the IRA or other. Unfortunately, you'll still need to take RMDs from your IRAs. "However, rolling an IRA into your (k) would allow you to delay those RMDs, too," says Hayden. Rolling over a (k) into a new or existing traditional or Roth IRA is just one option to consider. Options include roll it, leave it, move it, or take it.

Treasure Moving Company

Treasure Moving Company is a Maryland Moving Company providing professional and stress free moving services in Rockville, Maryland at reasonable prices. The better way to hire moving companies in Treasure, MT. Compare quotes, read Treasure mover reviews and book online or give us a call 7 days a week. TREASURE MOVING COMPANY, Rockville, MD , 75 Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm, Thu - am - pm. We've reviewed JK Moving Services, Treasure Moving Company and other top movers in Maryland. Read here to learn about the best movers in the Old Line State. Treasure Coast Movers for Over 43 years. Local and Long Distance Moving Serving Port St. Lucie, Vero Beach, Stuart, Palm City, Jupiter Top Rated Moving. A Parklawn Dr Rockville, MD [email protected] mdv-yk242.ru Treasure Moving Company is a Maryland Moving. Professional Moving Services based out of Rockville, Maryland serving all of Maryland/Virginia/Washi. . Follow. . Posts. Treasure Moving Company - Get Free Quotes! - We offer a wide range of services like Storage Services, Residential Movers, Local Movers, Long Distance Movers. This organization is not BBB accredited. Moving and Storage Companies in Rockville, MD. See BBB rating, reviews, complaints, & more. Treasure Moving Company is a Maryland Moving Company providing professional and stress free moving services in Rockville, Maryland at reasonable prices. The better way to hire moving companies in Treasure, MT. Compare quotes, read Treasure mover reviews and book online or give us a call 7 days a week. TREASURE MOVING COMPANY, Rockville, MD , 75 Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm, Thu - am - pm. We've reviewed JK Moving Services, Treasure Moving Company and other top movers in Maryland. Read here to learn about the best movers in the Old Line State. Treasure Coast Movers for Over 43 years. Local and Long Distance Moving Serving Port St. Lucie, Vero Beach, Stuart, Palm City, Jupiter Top Rated Moving. A Parklawn Dr Rockville, MD [email protected] mdv-yk242.ru Treasure Moving Company is a Maryland Moving. Professional Moving Services based out of Rockville, Maryland serving all of Maryland/Virginia/Washi. . Follow. . Posts. Treasure Moving Company - Get Free Quotes! - We offer a wide range of services like Storage Services, Residential Movers, Local Movers, Long Distance Movers. This organization is not BBB accredited. Moving and Storage Companies in Rockville, MD. See BBB rating, reviews, complaints, & more.

Treasure Moving's phone number is () What is Treasure Moving's official website? Treasure Moving's official website is mdv-yk242.ru What. We are the best choice for your local or long distance move in Maryland, DC & Virginia. Free and open company data on Maryland (US) company TREASURE MOVING COMPANY, LLC (company number W), FERRARA DR., SILVER SPRING, MD, It has set the bar high for itself, assuring that your belongings are protected from damage. Treasure Moving Company is a licensed and insured business catering. We are Houston's top rated residential and commercial moving company because we put our customers first. Packing and Unpacking. We diligently help you pack and. Moving Company they broke several things that wrong did not pay me back for them came super late about four hours mdv-yk242.ru of the guys can help move my. Get information, directions, products, services, phone numbers, and reviews on Treasure Moving Company in Rockville, undefined Discover more Installation or. Treasure Moving Company. We are Treasure Moving Company, the best choice for your local or long distance move in Maryland. We know that moving can be a. Find phone number, address and business hours for Treasure Moving Company located at Parklawn Dr Rockville MD, () - on. Moving Service · North Bethesda, Maryland · Directions · Call · Website. More. Claim This Place. Details. Hours. Every Day. AM – PM. Closed Now. Treasure Moving Company is a moving company in Washington DC, DC. Get moving quotes, read reviews & find movers for your next move. Treasure Moving Company is a professionally staffed, licensed, and insured local moving company based out of Rockville Maryland serving the Washington DC. 1 Fave for Treasure Moving Company from neighbors in Rockville, MD. The best choice for your local or long distance move in Maryland, Treasure Moving. My wife and I are just about to use a company called Treasure Moving Company for the 2nd time. Our first experience with them was great, so. Treasure Moving Company, Rockville, Maryland. likes. Professional Moving Services based out of Rockville, Maryland serving all of. Treasure Moving Company, a company based in Rockville, MD, has revealed that they are ready to provide local and out of state moving services serving Rockville. Need help moving your home or office? Reach out to Treasure State Moving, LLC for help. Call us at to schedule expert moving services. Company overview. Treasure Moving Company Llc is an active carrier in Silver Spring, Maryland. Treasure Moving Company Llc transports household, and more. Treasure Moving Company is a professionally staffed, licensed, and insured local moving company based out of Rockville, Maryland serving the Washington DC. North Bethesda, Maryland -. Treasure Moving Company, a moving company based in Rockville, MD, is pleased to announce that they are offering a wide variety.

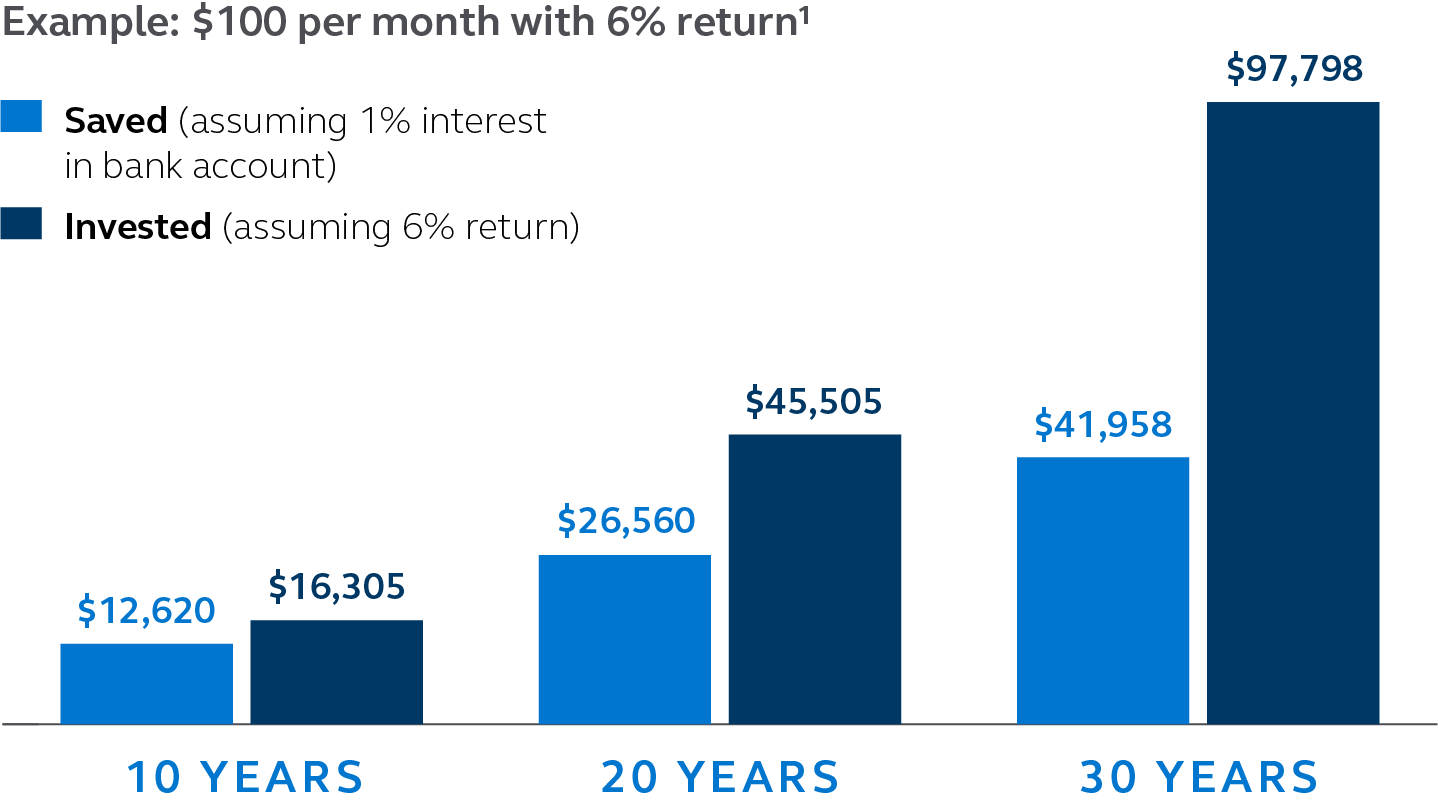

Investing $100 A Month For 30 Years

frequency. Monthly. Annually. Years of growth. Years. Estimated rate of return. Compound frequency. Daily, Monthly, Annually. Calculate. Total Balance. We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. Even if you don't have access to a k you can open an IRA and contribute your $/month to that. Vanguard tracker funds are very good. Invest in your future by enrolling in Vanguard Digital Advisor® with just $ Error: Enter a monthly income less than $16,, Month Year. error. Value of $ invested at start of in, Annual Risk Premium, Annual Real Returns. Year, S&P (includes dividends), 3-month mdv-yk242.ru, US T. Bond (year). Think about this: If you invest $ a month for 30 years with an average annual return of 7%—which is pretty reasonable for a diversified stock portfolio—you. It can seem like a waste of time investing a small amount of money, but that first step can eventually lead to a future of growth. Here's what you need to. See how consistently investing $ a month could add up to $, over 30 years. In time, $ a month can go a long way.*. Bar Chart: $1, after 1 year. Learn how a monthly investment of just $ can help build a future nest egg using properly diversified stocks or stock mutual funds. frequency. Monthly. Annually. Years of growth. Years. Estimated rate of return. Compound frequency. Daily, Monthly, Annually. Calculate. Total Balance. We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. Even if you don't have access to a k you can open an IRA and contribute your $/month to that. Vanguard tracker funds are very good. Invest in your future by enrolling in Vanguard Digital Advisor® with just $ Error: Enter a monthly income less than $16,, Month Year. error. Value of $ invested at start of in, Annual Risk Premium, Annual Real Returns. Year, S&P (includes dividends), 3-month mdv-yk242.ru, US T. Bond (year). Think about this: If you invest $ a month for 30 years with an average annual return of 7%—which is pretty reasonable for a diversified stock portfolio—you. It can seem like a waste of time investing a small amount of money, but that first step can eventually lead to a future of growth. Here's what you need to. See how consistently investing $ a month could add up to $, over 30 years. In time, $ a month can go a long way.*. Bar Chart: $1, after 1 year. Learn how a monthly investment of just $ can help build a future nest egg using properly diversified stocks or stock mutual funds.

Historically, the year return of the S&P has been roughly 10–12%. Calculate. Your Results. Estimated Retirement Savings. In 0 years. Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. We sell Treasury Bonds for a term of either 20 or 30 years. Bonds pay a fixed rate of interest every six months until they mature. The Standard & Poor's ® (S&P ®) for the 10 years ending December Since , the highest month return was 61% (June through June ). $ a month invested from age 25 to 65 is $1,, You do NOT have to retire broke. A lot of people will want to argue with me on that rate. I bonds: Another type of low-risk government bond that ties its interest rate to inflation and can last up to 30 years. You can redeem an I bond after 12 months. Emily, 30 years old. Emily has enough The 'Investment', however, is the amount of money you want to add to your portfolio each week, month or year. The longer you have to invest, the more time you have to take advantage of the power of compound interest. That's why it's so important to start investing at. To calculate how much the cost of a fixed "basket" of consumer purchases has changed using monthly Enter the year in which the money was first invested. End. Want to know how much you can grow your money? If you start now, your investment of S$ per month for 30 years at % per annum rate of return* could make. If you are lucky enough to be able to afford an investment horizon of 30 years, probably low-cost index funds (S&P index) are the safest. year mortgage rates · year mortgage rates · VA loan rates. Get guidance per month, per quarter, per year. X. Contribution frequency: The frequency you. The longer you have to invest, the more time you have to take advantage of the power of compound interest. That's why it's so important to start investing at. Investing—the value of time ; Years , $0, $70,, $/month, $52, ; Years , $0, $,, $/month, $, monthly investments of $ over 20 years with a 7% return rate. Note that Graph showing five regular $ monthly investments: 6 shares at $50 each. year mortgage rates · year mortgage rates · VA loan rates. Get guidance per month, per quarter, per year. X. Contribution frequency: The frequency you. account or investment that earns 5% a year, it would grow to $ by the end of 5 years, and by the end of 30 years, to $1, That's the power of. Obviously, the more you can invest, the more you could accumulate over the long term. Monthly contributions of $ a month at a 5% return rate would grow to. month year. Results. You will need to invest years to reach the target of $1,, 30 Starting Amount Contributions Interest. If you check the box to adjust this amount for inflation, your annual investment will increase each year by the inflation rate. Frequency of contributions. How.

Can I Have Pizza Delivered To A Hotel

Don't see your hotel, apartment, or zip code listed? We may still deliver to you! Chances are if you're within 3 miles of one of our locations, we will bring. pizza delivery service $5 delivery charge within the main hotel. $10 delivery charge to Greenbrier. Yes, many pizza delivery services offer a variety of sides, desserts, and beverages that you can order along with your pizza. Conclusion. Pizza. Get started with our room service by scanning the QR code to download the Grubhub app. · Open GrubHub and select your delivery location. Food pickup may be. You can have a pizza delivered to any hotel, in any city, as long as your hotel is in the pizza establishment's delivery area. Delivery or carry out, late night or right now - Toppers Pizza has you covered. Try our famous Topperstix cheesy bread or one of our specialty pizzas now. With the Staybridge Suites In-Room Pizza Package, you can have a pizza and Package components may vary by region and by hotel. Any unused. Once you've found a Domino's restaurant near you now, you may find it easier to have your food delivered rather than pick it up. Maybe you're staying in a hotel. Just order the Pizza from the Food court. Way easier and saves time and money. Prerana. Don't see your hotel, apartment, or zip code listed? We may still deliver to you! Chances are if you're within 3 miles of one of our locations, we will bring. pizza delivery service $5 delivery charge within the main hotel. $10 delivery charge to Greenbrier. Yes, many pizza delivery services offer a variety of sides, desserts, and beverages that you can order along with your pizza. Conclusion. Pizza. Get started with our room service by scanning the QR code to download the Grubhub app. · Open GrubHub and select your delivery location. Food pickup may be. You can have a pizza delivered to any hotel, in any city, as long as your hotel is in the pizza establishment's delivery area. Delivery or carry out, late night or right now - Toppers Pizza has you covered. Try our famous Topperstix cheesy bread or one of our specialty pizzas now. With the Staybridge Suites In-Room Pizza Package, you can have a pizza and Package components may vary by region and by hotel. Any unused. Once you've found a Domino's restaurant near you now, you may find it easier to have your food delivered rather than pick it up. Maybe you're staying in a hotel. Just order the Pizza from the Food court. Way easier and saves time and money. Prerana.

After a day of coasters and stuff, I'm gonna want some pizza for dinner (well, not every night, mind you). Question, however - will the major pizza chains in. After a day of coasters and stuff, I'm gonna want some pizza for dinner (well, not every night, mind you). Question, however - will the major pizza chains in. And we've been delivering that same food and service ever since. For the Love of Pizza Since From day one, the Carney brothers could look their customers. The hotel's food court, Pier 8 Market, offers a great selection of flavorful can have pizza delivered to your room. Universal Endless Summer Resort. Have you ever wondered if you can order Grubhub to your hotel? Good news for you, it is easier than ever. Many hotel kitchens have rigid meal ordering. Call the pizza place and ask if they'll deliver to your hotel. They will if you are within their delivery range. Then place your order and tell. Yes, any with delivery, just need to meet them in the front lobby. Yes. My hubby always orders from Flippers when we're at the resorts. I. Simply - yes! They will ask for your room number. we strive to provide expert food and pizza delivery whichever way you prefer. You can now choose how you get your favorite Papa John's order delivered to you! What else can I get delivered from MOD Pizza? MOD also delivers fresh custom salads with the same unlimited 40+ ingredient choices! Or, try our Cheesy Garlic. The party line was best stated by Wynn, whose representative wrote us to say, “All food-delivery services must coordinate delivery directly with the guest and. Getting food delivered to your hotel is just like getting it delivered anywhere else, only with a little more coordination to ensure that your food gets to the. Dominos has an exclusive at the resorts as they have a location on-site. For anything else, you will need to pick it up yourself. Maverick since ' +0. Things to do with Domino's App. - Explore the menu for your favourite veg & non-veg pizzas, sides, pizza mania, meals & combos and desserts too. Hotel · Hard Rock Hotel · Loews Royal Pacific Resort · Sapphire Falls Resort delivered right to you, whenever and wherever you got hungry? Delizioso. Pizza Delivery to your Room or Poolside! Why leave the Wilderness or even the pool for pizza delivery when you can have your Klondike Pizza delivered right. Disney resorts with In-Room Pizza Delivery include: All-Star Movies, All-Star Music, All-Star Sports, Caribbean Beach Resort, Old Key West, Pop Century Resort. Get delicious and tasty food delivered! Order from your nearest Domino's in the US for pizza, pasta, chicken, salad, sandwiches, dessert, and more. Complete a stay at an ES Suites or Simply Suites hotel to try Grubhub+ free for two months and enjoy $0 delivery fees on all eligible orders. Sign up will be. Sarpino's Pizza offers free fast delivery of delicious food to Snooze Hotel, with no minimum order and online ordering. We are open late.

Rv Full Time Insurance

We can write high-value motorhomes and older RVs; We offer full time travel coverage, overland water (flood) protection, roadside assistance, and more! Full-time RV insurance is for those who use their RV as their primary residence. The insurance is similar to a homeowner's policy. Full-time RV insurance covers. No matter how you use your RV, you'll still need insurance to cover any damage to the vehicle itself, as well as risks such as fire, theft of your personal. We work with some of the top insurance companies in the country to custom create an insurance policy that protects your Class A, B or C motorhome, travel. Full time coverage: Full time RV insurance offers a set of coverages for people who live full time in their RV. This includes personal liability, emergency. Full-Timer coverage can help with personal liability protection when your motor home is parked and used as a dwelling for an extended period of time. Farmers. Full time RV insurance is designed to protect owners who use their RV either as a primary residence or who live in their RV six months out of the year. The unexpected is part of the thrill when you're checking out the sights from your home on wheels. With RV insurance you can make sure that whatever comes. Need the right coverage for your RV? Find out how our RV insurance and Grand Touring Solution can cover your motorhome or recreational trailer all year. We can write high-value motorhomes and older RVs; We offer full time travel coverage, overland water (flood) protection, roadside assistance, and more! Full-time RV insurance is for those who use their RV as their primary residence. The insurance is similar to a homeowner's policy. Full-time RV insurance covers. No matter how you use your RV, you'll still need insurance to cover any damage to the vehicle itself, as well as risks such as fire, theft of your personal. We work with some of the top insurance companies in the country to custom create an insurance policy that protects your Class A, B or C motorhome, travel. Full time coverage: Full time RV insurance offers a set of coverages for people who live full time in their RV. This includes personal liability, emergency. Full-Timer coverage can help with personal liability protection when your motor home is parked and used as a dwelling for an extended period of time. Farmers. Full time RV insurance is designed to protect owners who use their RV either as a primary residence or who live in their RV six months out of the year. The unexpected is part of the thrill when you're checking out the sights from your home on wheels. With RV insurance you can make sure that whatever comes. Need the right coverage for your RV? Find out how our RV insurance and Grand Touring Solution can cover your motorhome or recreational trailer all year.

Choose travel/camping trailer insurance if what's to be insured is towed, or can't be driven on its own. What sets State Farm RV Insurance apart? 19, agents. Allstate's policy options also include full-timer's liability coverage. This coverage is available to those who use an RV as a permanent residence for more than. Total Loss Replacement; Purchase Price Guarantee; Disappearing Deductible; Personal Effects Replacement; Full-Timers Liability; Vacation Liability; Emergency. The average Texan pays about $1, per year in premiums for RV Insurance. However, like most insurance policies, RV insurance premiums vary widely, in part. RV insurance covers your recreational vehicle in case of loss, damage or collision while it is in use and when it is in storage. Get a quote. Recreational RV owners can expect to pay less than $1, while full-time RV owners could pay as much as $2, to $3, When it comes to finding the cheapest. Most states require Bodily Injury and Property Damage Liability insurance on all types of motorhomes. However, RV insurance is optional for travel trailers. $1, or $5, of Replacement Cost Personal Effects coverage is automatically included at no additional cost with Comprehensive and Collision coverage. According to estimates, the average annual insurance premium for a gas-powered Class A motorhome is approximately $1,$1,, based on usage of days per. Market-leading insurance protection for RV owners and. Full-time RV insurance (sometimes referred to as Full-timers Coverage) is ideal for people who use their RV as their permanent residence. Full time RV insurance is a more comprehensive type of RV insurance policy that's specifically designed for those people who spend more than nights per. RVs, motorhomes and travel trailers are unique vehicles which need dependable insurance coverage from a specialist, like National General Insurance. It must be contained in, attached to or used in connection with your camper or motorhome (within 25 feet). This policy is limited to $, but you can purchase. ➤ Full-time coverage is available to those who use a travel trailer as a You can modify your RV coverage to act more like homeowners insurance, helping cover. No, your RV can be insured by itself. However, if you insure your RV and car on the same policy, you can get a multi-vehicle discount on your premiums. You will. We compare six top-rated companies to find the lowest rate. RV Insurance, Travel Trailer Insurance, Motorhome Insurance. () The average insurance cost ranges from around $1, to $4, or more per year. Class C motorhomes should be slightly cheaper to insure than Class As, with an. Full time RV insurance is a more comprehensive policy that applies to RV owners who live in their RV for a certain amount of time per year.

Credit Repair Authorized User

However, if you do not give access to your credit cards and they do not use them, they are unlikely to hurt your credit score. Authorized users. Other strategies include having someone cosign on your account or installment loan. You can also become an authorized user on a family member's account. Credit. Adding an authorized user should not effect his credit. The issuer should only report to the bureaus for the owner(s) of the account. An. We guarantee that the authorized tradelines will be added to your credit reports with in 20 to 25 days. It will populate on all 3 credit reports. If the bank reports the card's positive activity to credit bureaus for all users, it will also report unsatisfactory activity. Being an authorized user can hurt. This is a digital download e book that seeks to educate and inform you about the rudiments of adding an authorized user including how it helps build credit and. Becoming an authorized user for the purpose of credit card piggybacking, meaning you are not responsible for the debt, but the entire history of that account. In reality, the simple addition of an authorized user, in and of itself, won't affect your credit score. It's the user's behavior that has the chance to impact. credit history with a Credit Repair Companies? I'm wondering if I should keep myself on his account as an authorized user still or should I remove it and time. However, if you do not give access to your credit cards and they do not use them, they are unlikely to hurt your credit score. Authorized users. Other strategies include having someone cosign on your account or installment loan. You can also become an authorized user on a family member's account. Credit. Adding an authorized user should not effect his credit. The issuer should only report to the bureaus for the owner(s) of the account. An. We guarantee that the authorized tradelines will be added to your credit reports with in 20 to 25 days. It will populate on all 3 credit reports. If the bank reports the card's positive activity to credit bureaus for all users, it will also report unsatisfactory activity. Being an authorized user can hurt. This is a digital download e book that seeks to educate and inform you about the rudiments of adding an authorized user including how it helps build credit and. Becoming an authorized user for the purpose of credit card piggybacking, meaning you are not responsible for the debt, but the entire history of that account. In reality, the simple addition of an authorized user, in and of itself, won't affect your credit score. It's the user's behavior that has the chance to impact. credit history with a Credit Repair Companies? I'm wondering if I should keep myself on his account as an authorized user still or should I remove it and time.

People with bad credit scores can improve them by using credit repair in authorized user on the credit card of someone with a good score. However. An authorized user is an additional cardholder on someone else's credit card account. You have a credit card in your name that is linked to the primary. Adding someone as an authorized user on your credit card account can potentially help them improve their credit score. As an authorized user, they will have. When you are an authorized user of someone else's credit cards, their credit history for that account or accounts will report to your credit. Those who have become authorized users on credit cards find that the opportunity can help them boost their own credit and potentially repair credit scores. Credit Pro has been providing authorized user tradelines longer than any other company around since ! The most experience and the most competitive prices. Are you familiar with the credit boosting strategy of becoming an authorized user (otherwise known as "piggybacking") on another persons account? In most cases. Adding an authorized user should not effect his credit. The issuer should only report to the bureaus for the owner(s) of the account. An. Pay to become an authorized user: Credit card companies allow credit card Some credit repair companies may tell you to add them as authorized users to your. When you piggyback on someone else's credit card, you become an authorized user on their account. Usually, this is in service of establishing credit for the. If you have someone in your life with good credit, see if they'll let you become an authorized user of their credit card account. Your credit should start to. Pay to become an authorized user: Credit card companies allow credit card Some credit repair companies may tell you to add them as authorized users to your. When purchasing authorized user tradelines, when you get added to the credit card as an authorized user, it does not show on your credit report when you were. You add individuals as authorized users to credit cards in good standing and their credit scores increase. However, the practice of piggybacking credit becomes. The fact that authorized users are not on the hook for bill payments is one big reason why credit card companies don't need to check an authorized user's credit. Adding someone to your credit card as an authorized user is a great way to help them build credit. As long as you and the added user manage the account. Authorized user accounts can appear on your credit report and impact your FICO® Score. This means that both positive and negative information can impact the. Becoming an authorized user on a credit card can be a great way to improve credit score. An authorized user is someone who is added to the primary cardholder's. Not all banks and card issuers provide authorized users' card payments to the credit reporting bureaus. Before you go through the approval process, check with. Authorized users can use your account subject to the terms and conditions of the Credit Card Agreement and Disclosure. You are responsible for paying any.

What Is Shib Cryptocurrency

The live Shiba Inu price today is $ USD with a hour trading volume of $ USD. We update our SHIB to USD price in real-time. The price of Shiba Inu is $ Buy Shiba Inu - SHIB with $1. Invest in SHIB cryptocurrency with Robinhood in the easiest and fastest way. The SHIB coin is an ERC token powered by Ethereum. As it runs on the Ethereum network, Shiba Inu can leverage smart contracts to create decentralized finance. Shiba Inu (SHIB) is a memecoin and Ethereum-based cryptocurrency that was launched as a community project in by an anonymous individual or group called. Exercise caution when investing in cryptocurrencies. Regulatory disclosures. Cryptocurrency services provided by Bakkt Crypto. Cryptocurrency assets are held in. SHIB is a meme coin that uses the Shiba Inu dog breed as its mascot just like DOGE. It recently shot into the limelight on the backdrop of increasing interest. Shiba Inu (SHIB) is our key token, embodying a global, decentralized, community-driven currency. Launched in , this Ethereum-based token is a global. Shiba Inu token (ticker: SHIB) is a decentralized cryptocurrency created in August by an anonymous person or group using the pseudonym "Ryoshi". It is. Shiba Inu is a cryptocurrency meme token launched by an anonymous founder called Ryoshi. Like Dogecoin (DOGE %), it's based on the Doge meme, which features. The live Shiba Inu price today is $ USD with a hour trading volume of $ USD. We update our SHIB to USD price in real-time. The price of Shiba Inu is $ Buy Shiba Inu - SHIB with $1. Invest in SHIB cryptocurrency with Robinhood in the easiest and fastest way. The SHIB coin is an ERC token powered by Ethereum. As it runs on the Ethereum network, Shiba Inu can leverage smart contracts to create decentralized finance. Shiba Inu (SHIB) is a memecoin and Ethereum-based cryptocurrency that was launched as a community project in by an anonymous individual or group called. Exercise caution when investing in cryptocurrencies. Regulatory disclosures. Cryptocurrency services provided by Bakkt Crypto. Cryptocurrency assets are held in. SHIB is a meme coin that uses the Shiba Inu dog breed as its mascot just like DOGE. It recently shot into the limelight on the backdrop of increasing interest. Shiba Inu (SHIB) is our key token, embodying a global, decentralized, community-driven currency. Launched in , this Ethereum-based token is a global. Shiba Inu token (ticker: SHIB) is a decentralized cryptocurrency created in August by an anonymous person or group using the pseudonym "Ryoshi". It is. Shiba Inu is a cryptocurrency meme token launched by an anonymous founder called Ryoshi. Like Dogecoin (DOGE %), it's based on the Doge meme, which features.

Shiba Inu (SHIB) is a cryptocurrency and operates on the Ethereum platform. Shiba Inu has a current supply of ,,,, with. In , Changelly predicts that the average price of SHIB could be $ while Coingape sees the token to trade at an average of $ Shiba Inu is a decentralized blockchain ecosystem powered by a trio of native tokens - namely SHIB, BONE, and LEASH. The cryptocurrency project is named after a. A look at the Shiba Inu crypto project, a memecoin ecosystem that utilizes LEASH, BONE, and SHIB tokens, has its own DEX (ShibaSwap), and is looking to. SHIB is an experiment in decentralised spontaneous community building created under the Shiba Inu's's ecosystem. Unlike Bitcoin, which is designed to be scarce. Shiba Inu (SHIB) also known as Shiba Token is a decentralized cryptocurrency and dog meme token on the Ethereum network ERC token standard. Live SHIB Price Analysis. The current real time Shiba Inu price is $, and its trading volume is $,, in the last 24 hours. SHIB price has. The price of Shiba Inu (SHIB) is $ today with a hour trading volume of $,, This represents a % price decline in. SHIB price today is $, with a live price change of in the last 24 hours. Convert, buy, sell and trade SHIB on Bybit. Shiba Inu coin is based on Ethereum and is the fastest-growing cryptocurrency in the top by market capitalization. Shiba Inu (or SHIB) is a token designed to be an Ethereum-compatible alternative to Dogecoin (DOGE). Like DOGE, SHIB is intentionally abundant. SHIB has been launched as a decentralized cryptocurrency built on the Ethereum blockchain. It is a deflationary token designed to be used as a medium of. - The live price of SHIB is $ with a market cap of $B USD. Discover current price, trading volume, historical data, SHIB news. Shiba Inu coin is based on Ethereum and is the fastest-growing cryptocurrency in the top by market capitalization. About Shiba Inu. The price of Shiba Inu (SHIB) is $e-5 today, as of Aug 30 a.m., with a hour trading volume of $M. Over the last 24 hours. Zengo allows you to securely buy and trade Shiba Inu for US dollars across multiple payment partners. Zengo is a crypto wallet that anyone can access and use. The current price of Shiba Inu (SHIB) is USD — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out. What is Shiba Inu price today? Shiba Inu is down by %. Shiba Inu price as on Aug 31, , PM was Rs Shiba Inu (SHIB) Price Today. The current Shiba Inu price is $ In the last 24 hours Shiba Inu price moved %. The current SHIB to USD conversion. Use this page to follow news and updates regarding SHIBA INU coin price, create alerts, follow analysis and opinion and get real time market data.

Companies With Best Stock Options

Here are six things employees at private companies need to know about their private company stock options: good decision. 3. Pay tax bills out of pocket at. We'll be diving into the the best stocks for options trading and exploring some of the best stocks for this thrilling venture. Most Active Options ; Apple (AAPL), ,, iPhones, computers ; Advanced Micro Devices (AMD), 1 million, Semiconductors ; mdv-yk242.ru (AMZN), ,, E-commerce. • However, it is generally in the best interest of both company and employee company and receives shares for each option exercised. • If there has. Option holders stand to make a great Ideally, you want to cash in on your stock options when the company's share price rises above the strike price. Discover ideas, tips and best practices to evolve your workplace and your Learn why companies reprice stock options and the mechanics of a repricing. Best stock for trading options: [1] Futu Holdings [2] Netflix [3] Upstart [4] Moderna [5] Mohawk Industries [6] Apple [7] Nvidia. Schwab's daily stock options market update provides you with the latest activity, news, insights, and commentary from Schwab's top trading experts. Startup stock options are a form of equity compensation that startup founders offer to their employees. In essence, they are an agreement between the employer. Here are six things employees at private companies need to know about their private company stock options: good decision. 3. Pay tax bills out of pocket at. We'll be diving into the the best stocks for options trading and exploring some of the best stocks for this thrilling venture. Most Active Options ; Apple (AAPL), ,, iPhones, computers ; Advanced Micro Devices (AMD), 1 million, Semiconductors ; mdv-yk242.ru (AMZN), ,, E-commerce. • However, it is generally in the best interest of both company and employee company and receives shares for each option exercised. • If there has. Option holders stand to make a great Ideally, you want to cash in on your stock options when the company's share price rises above the strike price. Discover ideas, tips and best practices to evolve your workplace and your Learn why companies reprice stock options and the mechanics of a repricing. Best stock for trading options: [1] Futu Holdings [2] Netflix [3] Upstart [4] Moderna [5] Mohawk Industries [6] Apple [7] Nvidia. Schwab's daily stock options market update provides you with the latest activity, news, insights, and commentary from Schwab's top trading experts. Startup stock options are a form of equity compensation that startup founders offer to their employees. In essence, they are an agreement between the employer.

NSOs are great for companies, as they minimize cash compensation an employee would earn during their employment. Non-qualified stock options are advantageous. With good planning and appropriate diversification, equity The act of purchasing company shares awarded through an options grant at the established strike. Stock options serve as a great Our most popular works on legal structuring for stock options is for businesses issuing options for the US or UK companies. These are typically the company issuing the stock options and the employee receiving the options. 10 Best Banks For Startups in · Startup Payroll · Best. An employee stock option (ESO) is a type of equity compensation granted by companies to their employees and executives. company the best it can be. An equity arrangement, like a stock option, can be mutually beneficial to both sides of the employment relationship and has. According to the National Center for Employee Ownership, about 36% of the workforce owns shares in their companies' stocks. ESOs can be a good investment, but. The mechanics of a stock option was a simple idea – you received an option (an offer) to buy a part of the company via common stock options . Use this work to approximately relate the company to its last round valuation: if it has been doing well by most measures, there's a good chance it is worth far. Video included! Be prepared for the difficulties of tax-return reporting with stock options, restricted stock units (RSUs), ESPPs, and sales of company shares. To choose the best equity compensation plan for your company, you'll need to weigh the pros and cons of each type for you and your employees. For example, ISOs. Now that companies such as General Electric, Microsoft, and Citigroup have accepted the premise that employee stock options are an expense, the debate on. A stock option plan provides employees with the ability to purchase shares of a company in the future at a predetermined price known as the strike price. A useful tool to attract and retain employees · The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% · A senior. Stock options and restricted stock units (RSUs) are two types of equity compensation that companies offer their employees. The company records the purchase price as the cash or cash equivalent it sacrificed to acquire the good or service. Suppose a clothing manufacturer were to. Stock options can be a great way to recruit and retain top talent, but there are a lot of boxes companies must check to ensure their plans are above board. good for the company. They hand-collected data on total employee stock options outstanding for these firms as well as actual share repurchases per year. I've seen some cases where they are valid for 10 years (for private companies, they may be valid forever once they have vested. Options may be the best way, tax. Everything about options, startup investing and more. Home. Stock Options Guide. Employee Stock Options. Startup Investing. Company.